Office of the

Santa Fe County Assessor

Isaiah F. Romero | Assessor (D) | Term 2023 - 2026

Welcome

The Office of the Santa Fe County Assessor

Our Mission

We are committed to providing excellent customer service through open communication, transparency, public outreach and education to the best of our ability, and with the utmost professionalism. We strive to provide the greater Santa Fe County with fair and equitable valuations based on New Mexico statutes and regulations, as well as industry best practice standards.

Our Values

We are committed to providing excellent customer service through open communication, transparency, public outreach and education to the best of our ability, and with the utmost professionalism. We strive to provide the greater Santa Fe County with fair and equitable valuations based on New Mexico statutes and regulations, as well as industry best practice standards.

Isaiah F. Romero | Assessor (D) | Term 2023 - 2026

“It’s YOU we value.”

Updates

Latest News

“

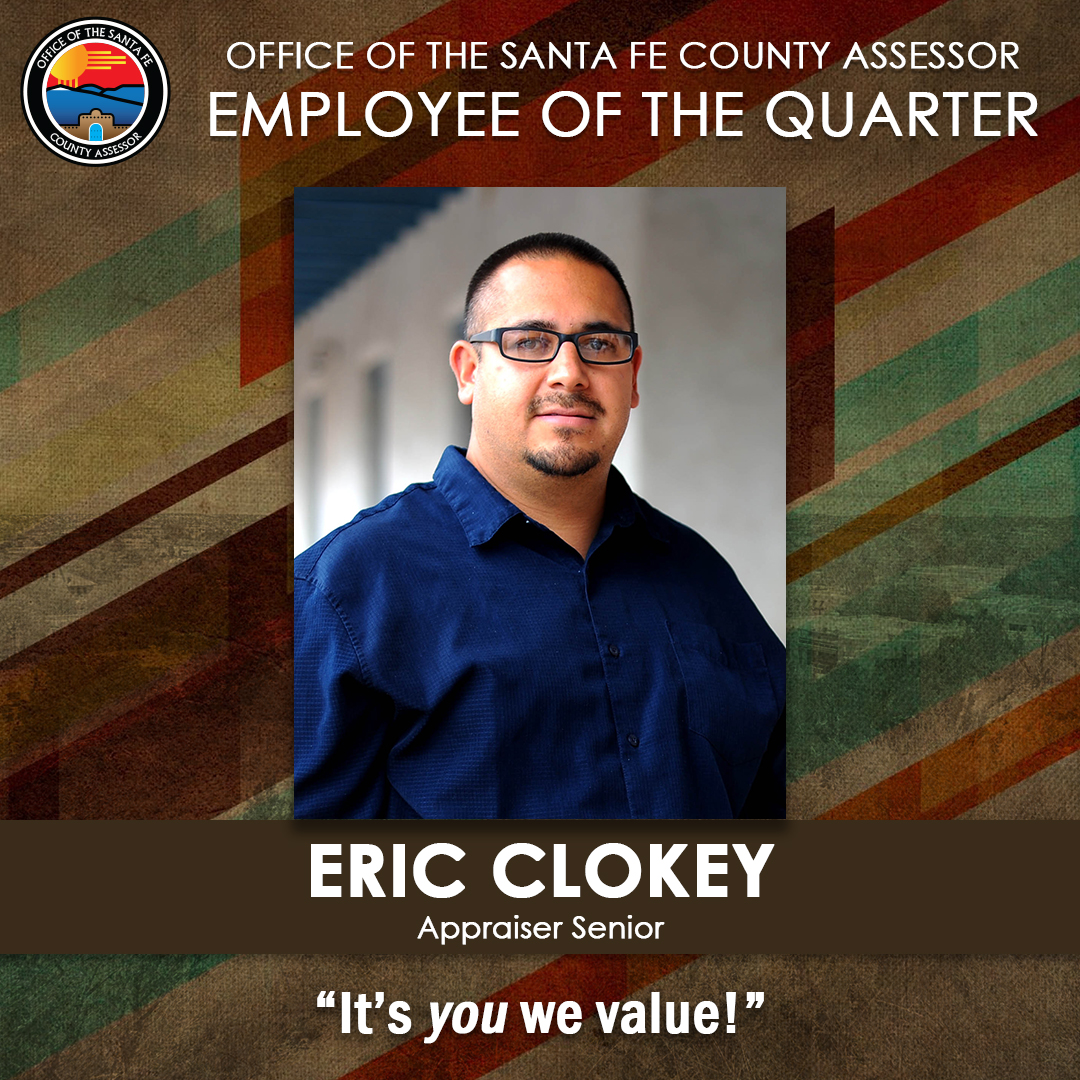

Employee of the Quarter

“Eric Clokey is one of the most genuine and kind individuals that we have working in our office. His leadership amongst the staff helps motivate and encourage people to work at their full potential. He is able to apply his experience and knowledge to not only provide excellent customer service for Santa Fe County constituents, he also takes time to mentor and advise staff to help do the same. Mr. Clokey is always ready to rally up a team to complete projects and tasks quickly. He spreads positivity and approaches everything with a “can do” attitude. He is a true leader who cares very much about the work he produces and about the people he works with. Mr. Clokey is a true asset to the office, providing trustworthy work, guidance and mentorship.”

JESSICA ULIBARRIA, CHIEF APPRAISER, REAL ESTATE APPRAISAL DEPARTMENT