Lodger’s Tax Payment

Santa Fe County Lodger's & Short Term Rentals

Santa Fe County is home to some of the most beautiful sites in America and is a vacation destination for many people that come from all parts of the country and the world. Santa Fe County is home to the capital City of Santa Fe which is home to some ofthe oldest communities in America. Santa Fe County is also home to many Pueblos which have resided there for centuries. The County and City's history, culture, art and food atrract many to our Hotels, Motels, and other hospitality tourist travel destination.

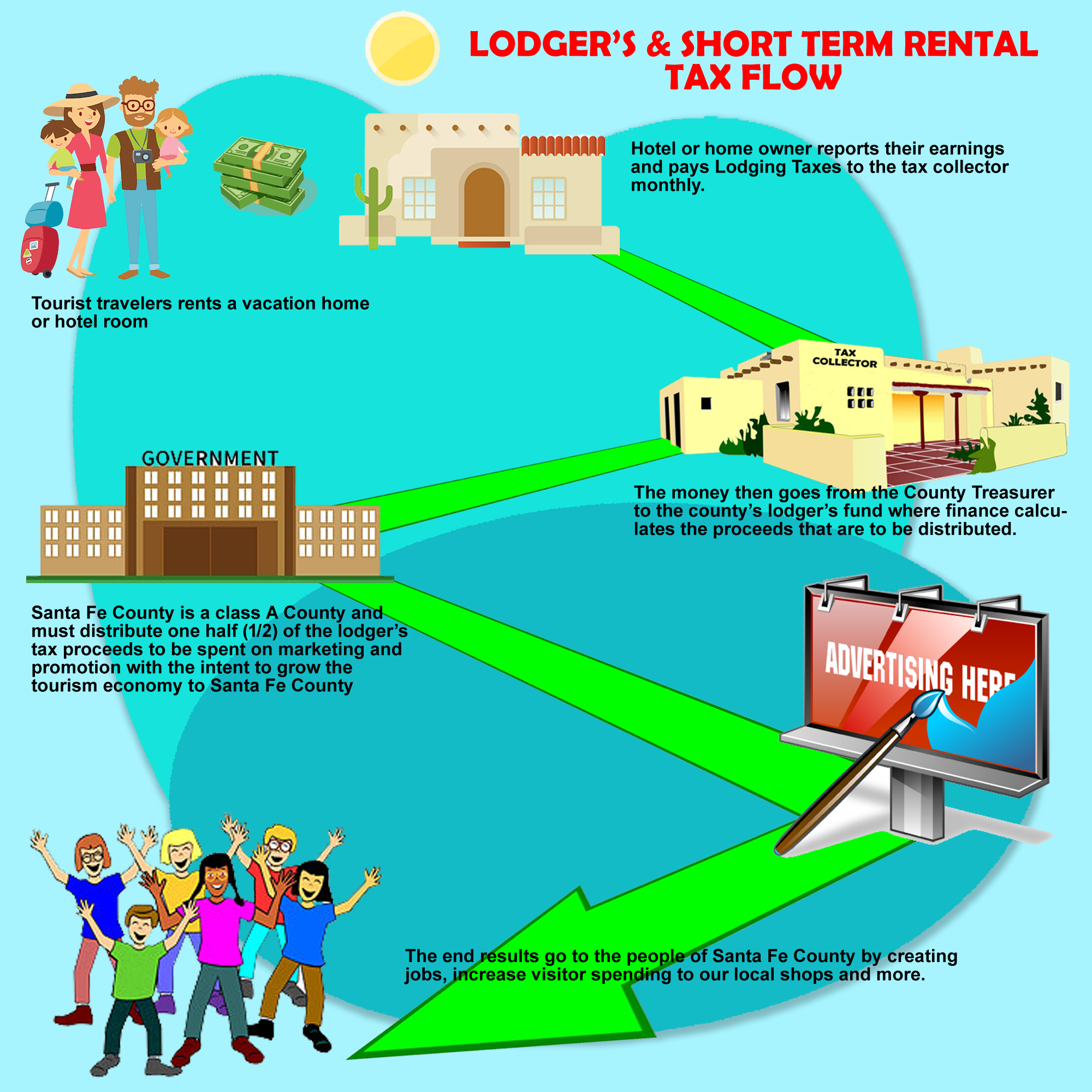

We value our tourist travelers to our County who have generated over 7 billion in spending to the State of New Mexico. However, with tourism to our state and county becoming more popular and a large number of short term rentals opening up all over our county, Santa Fe County and it's Board of County Commissioners have enacted an Ordinance (Ordinance No. 2023-02) broadening the previous lodger's tax adding short-term rentals. This Ordinance will help spread a level field between the hotels and short-term rental market and bring in revenue to the county.

Lodgings are rooms or other accommodations furnished from a vendor to a vendee by a taxable service of lodging for rent. Lodger's Tax is the tax on lodging, that must be reported monthly and taxes paid on or before the 25th of each month.

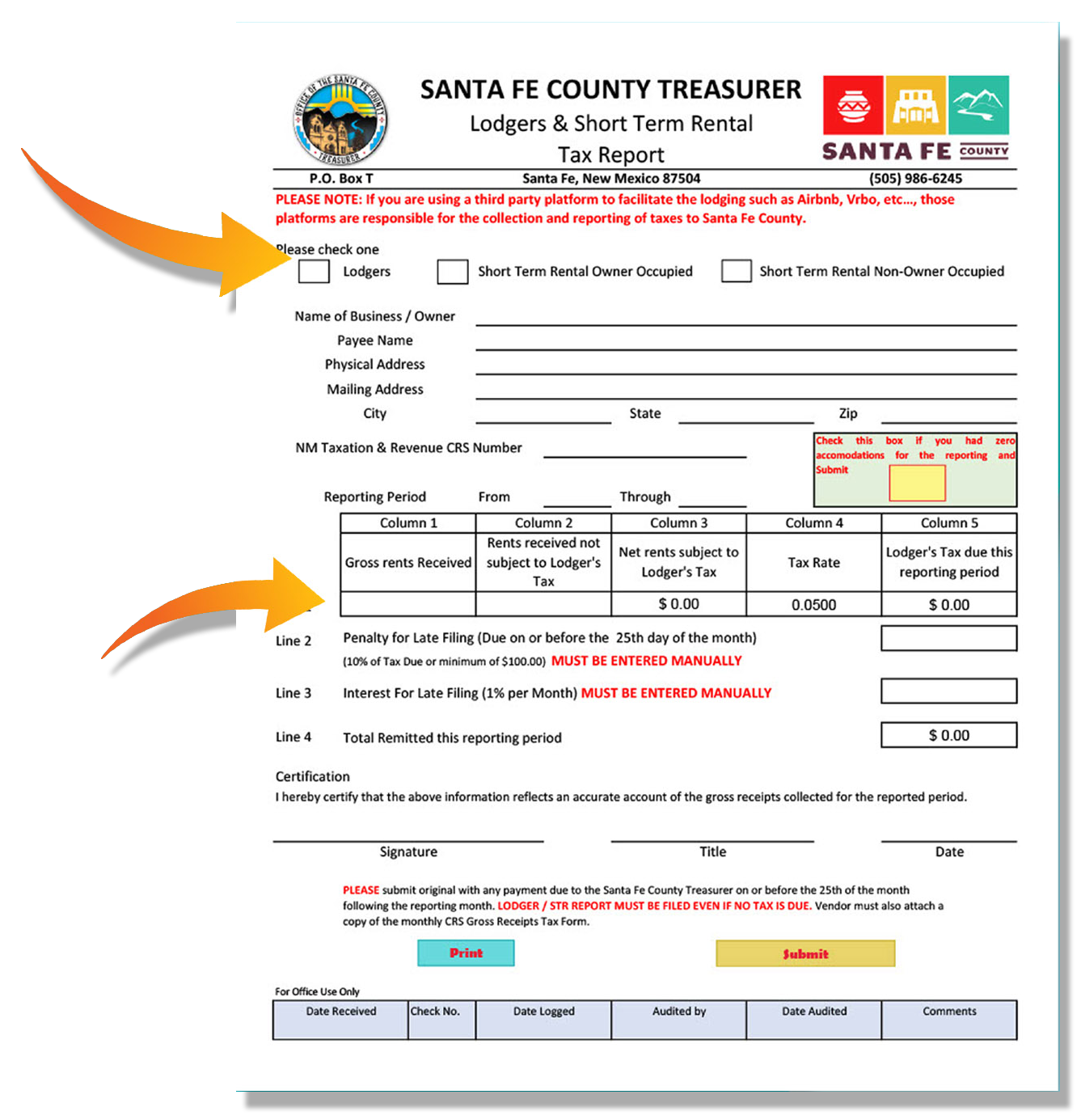

If you are using a Short-term rental platform such as Airbnb, they are responsible for the reporting and taxes to the County.

Short-Term Rentals (STRs) are any dwelling or portion thereof that is rented for periods of less thatn thirty (30) consecutive days. All of the Short-Term Rentals within the boundary of Santa Fe County must have a Business Licnese. If you do not have a license, visit our Building and Development STR page or call 505-995-2700 to schedule an appointment.

Fees are $375 for Non Owner-Occupied and $35 for Owner-Occupied

What is the difference between the two?

A Non Owner-Occupied dwelling is not occupied by the owner. For example: A second home that IS NOT the owner's primary residence, such as a second home.

An Owner-Occupied dwelling is the Owner's primary residence for at least 275 days per year or an Accessory Dwelling (Casita) located on the same legal lot of record.

How to fill out the Lodgers & Short-Term Rental Tax Report

Please check the Lodger's Box for reporting motels, hotels, rooming houses, campgrounds, trailer parks, RV Parks, B&B, or similar facilities.

Please check the STR Owner-Occupied if you own and live in the rental.

Please check the STR Non Owner-Occupied if you own the rental but do not occupy the dwelling.

In column 1 enter your total gross rental income received for the reporting period.

In column 2 enter your total rents recieved that are not subject to Lodger's Tax such as receipts received by trailer parks from the rental of a space for manufactured home or recreational vehicle for a period of at least one month, from lodgers, guests, roomers, or occupants. NMSA 7-9-53 (B)

Column 3 will populate. Column 4 is fixed and Column 5 will populate for your subtotal. line 4 "Total Remitted this reporting period" will populate. Sign, date, and submit.

If you have penalties and interest, you will have to calculate and enter them manually and your new Total for the month will populate. Sign, date, and submit.

For questions regarding Lodgers' Tax please email lodgers@santafecountynm.gov

Lodger's & Short Term Rental Tax Flow